#Fundbox invoice factoring full#

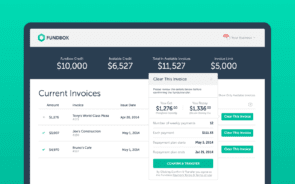

The full value of the invoices they select will be deposited into their bank accounts within one or two business days. Once that’s done, they can start clearing invoices from any connected device. Business owners simply need to create an account and link it with their bookkeeping app. Invoice financing services are easy to use. Instead of taking on unnecessary debt, small business owners can opt to use an invoice financing service like Fundbox to get advance payments on the bills customers haven’t paid yet. Some small business owners struggle to pay their bills despite the fact they have a lot of outstanding invoices piling up. When money’s tight, there are a number of outside financing options that small business owners can turn to in order to bridge cash flow gaps and redirect their focus on growing their companies. The good news is that while cash flow problems are common for small businesses, they don’t have to be a death sentence.

New equipment and technology may need to be purchased.Operating expenses (rent, supplies and utilities) can increase.Customers could take their time paying their bills.There are a number of reasons why cash can get tight for small businesses, including the following: Unfortunately, it’s not that simple.Īccording to a recent study, more than 60% of small business owners worry about their cash flow situation every month. Their bank accounts would always give them the financial flexibility necessary to pursue any and all opportunities for growth.

#Fundbox invoice factoring free#

Through Lendio’s free loan match tool, you can easily find out which loans are the best fit, and we match you with the best rates.If small business owners had it their way, they’d never have to worry about money. If your business really needs the money and needs it fast, single invoice factoring helps you get financing that other lenders are not willing to grant. In the end, a traditional loan from a bank is the better route, but that doesn’t always work. On the other hand, one of the benefits of single invoice factoring is that the lender is less concerned about credit score and more focused on cash flow while banks turn you down based on overall creditworthiness, a factor will focus on the quality of an invoice itself. In fact, it is one of the more expensive business financing options. Pros and Cons of Single Invoice Factoringīecause factoring companies assume a lot of financial risk, their fees can be quite pricey. That said, it is important to shop around and find the best rates before you decide to factor your invoices. Depending on the level of risk, some companies charge 30% or more in fees. Instead of interest rates, the factor charges fees of anywhere from 5% to 15% of the invoice. Single invoice factoring is technically not a loan, and it is therefore not bound by the same government regulations that traditional bank loans are bound by. With smaller sized deals, the advance is less. Factoring Rates and Termsįactors will typically advance only 70-90% of the receivables. Sometimes, depending on the service you choose, the factoring company itself might manage collecting on the invoice. The money that a customer owes you is considered an “outstanding invoice” – also referred to as an “accounts receivables.” In factoring, when you need the money before-hand, a third party, called a “factor,” comes in and essentially purchases your outstanding invoice. Depending on the business and the nature of your transactions, typical accounts receivables take up to 30 to 90+ days before the customer’s payment is received.įrom there, it is up to you to make sure the transaction is completed. This lets you factor purchases on an as-needed basis.įind a Business Loan – Free How Single Invoice Factoring Works Single invoice factoring differs from regular factoring services in the way that only one invoice is advanced instead of a contracted amount of invoices. This type of financing is helpful when you are waiting for a large payment from a customer but need the money immediately. Single invoice factoring is a business financing option that lets you advance the payment of your customers’ pending purchases.

0 kommentar(er)

0 kommentar(er)